Understanding these practices is crucial for ensuring accurate financial reporting and compliance with legal requirements. This guide aims to provide a comprehensive overview of essential partnership accounting practices, offering valuable insights for both new and experienced partnership accounting does not: accountants. With the bonus method, a new partner’s investments may or may not equal the book value of that individual’s capital investments. If the book value of the capital investments is exceeded, then the difference is distributed to the old partners as a bonus.

- Other common law jurisdictions, including England, do not consider partnerships to be independent legal entities.

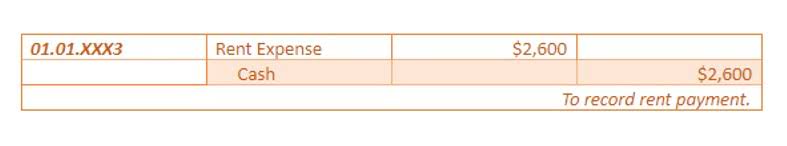

- The double entry is completed with credit entries in the old partners’ capital accounts.

- The interest on the loan will be a business expense and should therefore be debited to the statement of profit or loss.

- In an unequal partnership bonus is distributed according to the partnership agreement.

- Finally, the third type is a limited liability partnership (LLP), which provides all partners with limited personal liability against another partner’s obligations.

Bonus paid to a partner

If the book value is less than that of the capital investments purchased, then the bonus will be given to the new partner. The basics of accounting for a partnership business are similar to accounting for a sole proprietor. However, there are some key differences that are worth knowing when it comes to crunching the numbers. If a partner has a debit balance, as does C here, it is easy to include it in the tabulation as shown. There is no need to complicate matters by putting C’s account on the assets side of the balance sheet. If goodwill is to be retained in the partnership and therefore continue to be recognised as an asset in the partnership accounts, then no further entries are required.

Bonus Method

You’ll want to outline all key elements and terms clearly and comprehensively. To allocate the $10,000 bonus that each of the old partners will contribute to the new partner, Remi, make the following calculations. Here is a good (but long) video demonstrating the liquidation process and the journal entries required. All these questions and many more should be explored before choosing business partners. While you cannot predict the future or see all possible issues, doing your due diligence will help.

Allocation of net income

In other words, it means reconciliation of accounting income with taxable income, because not all accounting income is taxable. When normal operations are discontinued, adjusting and closing entries are made. Thus, only the assets, liabilities and partners’ equity accounts remain open. Assume that a sole proprietor agreed to admit a single equal partner for a certain amount of money. The sole proprietor, Partner A, will give the new partner, Partner B, an equal share in the partnership. 100% interest of the sole proprietor will be divided in half, so that each of the two partners will have 50% interest in the partnership.

- Typically, a valuation is performed at the date of death, and the remaining partners settle with the deceased partner’s estate either directly with cash or through distribution of the partnership’s assets.

- When a partner extracts funds from a business, it involves a credit to the cash account and a debit to the partner’s capital account.

- Read this CNN Money articleabout the Arthur Andersen case to see how courts can holdpartners liable.

- This is a variation on (b) above and always causes problems for candidates.

- A SMEis any entity that publishes general purpose financial statementsfor public use but does not have public accountability.

Assume that Partner A and Partner B have balances $10,000 each on their capital accounts. Most partnership agreements have provisions for the surviving partners to continue operating the partnership. Typically, a valuation is performed at the date of death, and the remaining partners settle with the deceased partner’s estate either directly with cash or through distribution of the partnership’s assets.

Limited Liability Partnership

- Instead, taxes are passed through to the individual partners to file on their own tax returns, often via a Schedule K.

- If a partner has a debit balance, as does C here, it is easy to include it in the tabulation as shown.

- On this basis, Partner A’s capital account is credited for $6,000 and Partner B’s is credited for $4,000.

- A capital account records the balance of the investments from and distributions to a partner.

Partnerships are often seen as having more favorable tax treatment than corporations. A successful partnership can give a new business more opportunities to succeed, but a poorly-thought out one can cause mismanagement and disagreements. Tax considerations also play a significant role in the allocation of profits and losses.

Partner compensation and allocated net income are considered ordinary income for tax purposes and as such are reported on the form 1040. It does not matter whether or not a partner withdrew any amount of money from his capital account. If a partner invested cash in a partnership, the Cash account of the partnership is debited, and the partner’s capital account is credited for the invested amount. When two or more individuals engage in enterprise as co-owners, the organization is known as a partnership. This form of organization is popular among personal service enterprises, as well as in the legal and public accounting professions. The important features of and accounting procedures for partnerships are discussed and illustrated below.

Accounting for initial investments

A partnership agreement helps prevent misunderstandings that can arise from verbal agreements by having everything in writing, ensuring all partners are on the same page. The journal entry to record Remi’s admission to the partnership and the allocation of the bonus to Dale and Ciara is as shown. Note that the entry is a paper transfer—it is to move the balance in the capital account. Instead, taxes are passed through to the individual partners to file on their own tax returns, often via a Schedule K.

Allocation of ownership interest

Partnerships are typically pass-through entities, meaning that the profits and losses are reported on the individual tax returns of the partners rather than at the partnership level. This can lead to complex tax situations, especially if the partners are in different tax brackets or if the partnership operates in multiple jurisdictions. Properly allocating profits and losses can help optimize the tax liabilities of the partners, making it a critical aspect of partnership accounting. A credit is applied to the cash account, and a debit is drawn from the partner’s capital account whenever a partner pulls funds or other assets from the business. Dissolution occurs when a partner withdraws(due to illness or any other reason), a partner dies, a new partneris admitted, or the business declares bankruptcy. Whenever there isa change in partners for any reason, the partnership must bedissolved and a new agreement must be reached.

For example, if profits are allocated based on capital contributions, the capital accounts of the partners will reflect these allocations, thereby affecting the overall equity distribution within the partnership. This, in turn, influences the balance sheet and the partners’ equity section, providing a transparent view of each partner’s financial stake in the business. Questions rarely bring in this point, because it makes the question easier.(e) Interest on drawings – partners sometimes agree that interest should be charged on drawings made. In reality, partners will agree the amount of drawings the business can stand rather than charge interest. If the point should come up, calculate the total interest due from all partners and add that to the net profit in the statement of division of profit. Then deduct each partner’s interest charge from the individual shares at the end of the statement.Balance sheet Each partner has to have a capital account and, probably, a current account in the balance sheet.

No responses yet